There was some excellent news for Western North Carolina home builders in the year-end report from the National Association of Home Builders (NAHB), but data for February suggests builders are now feeling uncomfortable with the outlook for tariffs and housing costs.

On the positive side, the NAHB’s year-end data for 2024 showed that the Asheville/Hendersonville area outperformed the nation and North Carolina in housing starts, based on permits. (The NAHB uses the Asheville metropolitan statistical area, which includes Buncombe, Henderson and Madison counties.)

The NAHB data shows that the Asheville MSA’s total permits for 2024 were up by 45.8% from 2023, to 5,585. Broken out by type, single-family permits were up 17.1% to 2,997 and multi-family permits were up 103.5% to 2,558.

“Certainly, the 2024 statistics show progress in supplying more housing in our area,” said Megan Carroll, Executive Officer of the Builders Association of the Blue Ridge Mountains. “That said, these gains do not change the fact that we badly need more housing that’s affordable, which only happens if we continue to increase our inventory of homes.”

The Asheville/Hendersonville area ran counter to national and state trends: Nationally, housing starts were down by 4.4% for the year vs. the previous year, with single-family starts down by 2.6% and multi-family starts down by 8.4%. North Carolina’s overall permits for 2024 were down by 3.6%, with single-family permits up by 6.7% and multi-family permits down by 24.2%.

Meanwhile, a recent measurement of the housing industry’s outlook for the future showed builder uncertainty as 2025 unfolds.

Builder Confidence Drops as Costs and Tariffs Rise

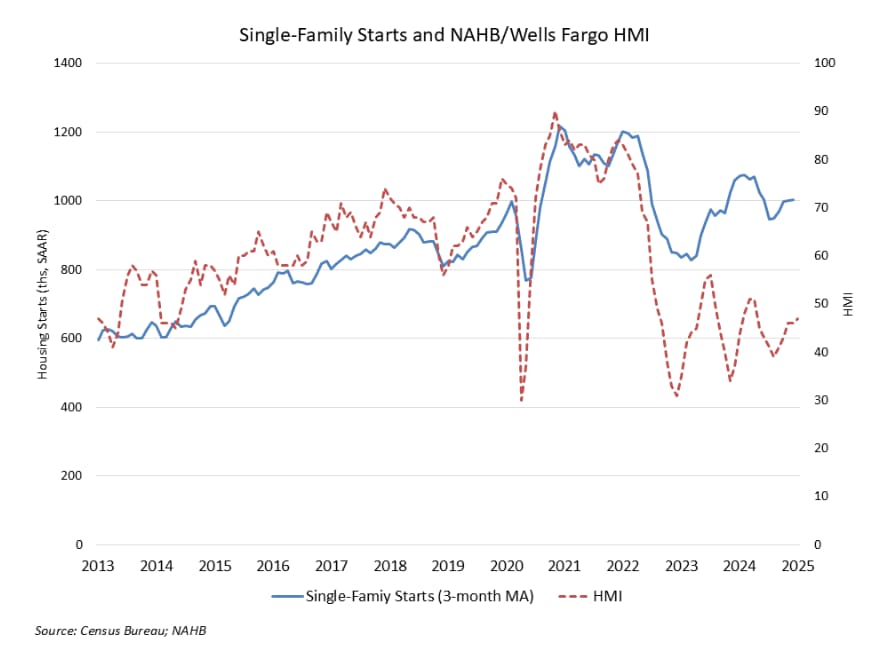

The monthly NAHB/Wells Fargo Housing Market Index, which has been conducted for more than 35 years, looks at three indicators of builder perceptions. Builders are asked to rate current home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The third indicator asks builder perception of traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

In February, according to NAHB economists, all three of the major HMI indices declined sharply in February. The HMI index gauging current sales conditions fell four points to 46, the component measuring sales expectations in the next six months fell 13 points to 46, and the gauge charting traffic of prospective buyers posted a three-point decline to 29, the NAHB reported.

The economists attribute the decline in positive sentiment to concerns about tariffs, higher mortgage rates and increased housing costs.